In a complex environment with contradictory signals, it is crucial to identify relevant variables to rationalize investment decision.

Ai for Alpha designs Artificial Intelligence solutions to help investment professionals understand key drivers of financial regimes and build resilient allocations.

Ai For Alpha makes the bridge between Ai and investment decisions

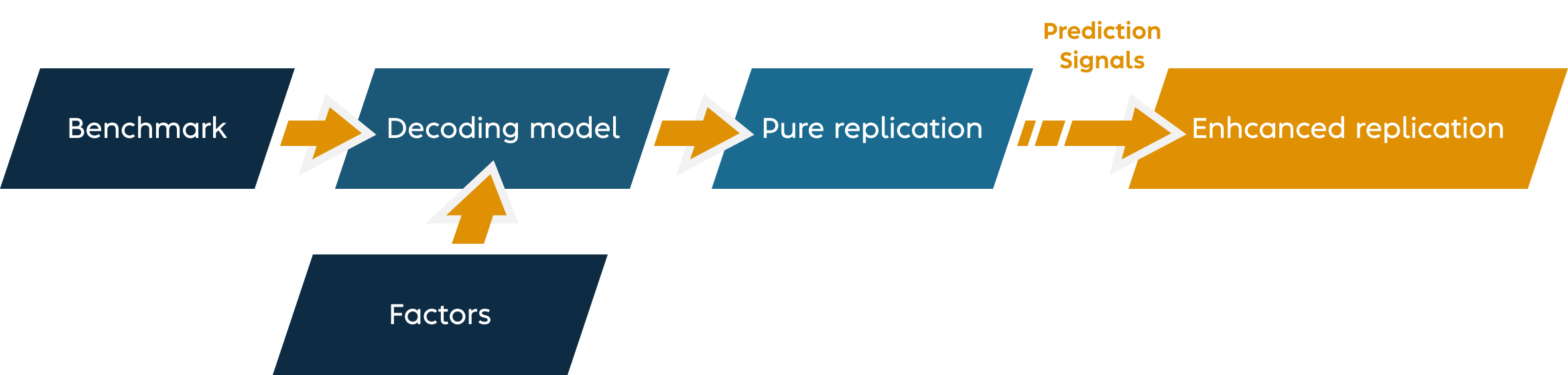

The model identifies the optimal portfolio that most closely replicates the performance of a specific benchmark.

Ai for Alpha licenses decoding portfolios to investors, providing liquid access to actively managed strategies.

Investors can choose between the most accurate replication (pure Decoding), or enhanced replications with a focus on alpha generation.

Tactical decoding uses prediction signals to selectively deviate from the pure replication, with the aim of improving performance while maintaining a strong correlation with the benchmark.

| Pure replication | Tactical position | Enhanced replication | |

|---|---|---|---|

| Equity | 30.0% | 2.0% | 32.0% |

| Bond | 49.0% | 3.0% | 52.0% |

| Commodity | 7.0% | -0.5% | 6.5% |

| Fx vs. USD | -60.0% | -10.2% | -70.2% |

| CDS Credit | 10.9% | 1.0% | 11.9% |

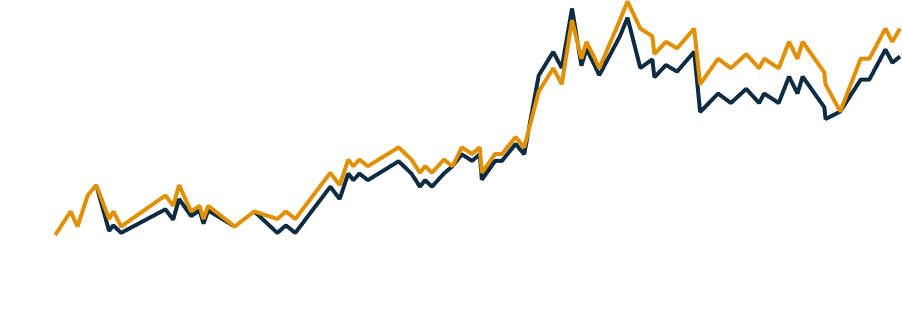

The Decoding Strategy is compared to the Benchmark in term of performance and risk on a daily basis.

| Decoding Accuracy | High |

| Correlation | 89% |

| Tracking error | 5.6% |

Realized correlation above 85%

Eliminate idiosyncrastic risk linked to a single asset manager

Strategies bases on liquid futures

Investors have access to the daily allocation and performance attribution on their portal

Optimized execution and structure fees

Our clients are

Béatrice has more than 20 years of experience in financial markets. She held various management positions in structuring departments in top tier US and European banks (JP Morgan, Deutsche Bank, Société Générale). Béatrice graduated from the engineering schools Ecole Polytechnique and ENSAE. She holds two masters’ degrees, in financial mathematics from LPSM (laboratoire de probabilités statistique & modélisation) and in finance from the London School of Economics.

Eric has held leadership roles as head of quants at Goldman Sachs and Natixis. He founded Pricing Partners, a startup focused on pricing complex financial products, which was later acquired by Refinitiv (formerly Thomson Reuters).

Ranked among the top 1% of researchers on SSRN (Social Science Research Network), Eric holds a global ranking within the top 10 among 500,000 researchers, with over 100 published papers and articles.

A graduate of Polytechnique, Eric also completed degrees at ENSAE and the London School of Economics. He holds three PhDs in Economics, Mathematics, and Computer Science, along with two master’s degrees, including one in AI from Dauphine and ENS Ulm. Additionally, he achieved the prestigious Agrégation in Mathematics.

Jean-Jacques has over 15 years' experience in investment management and research. During this time, he has designed various cutting-edge trading models for numerous asset classes.

Jean-Jacques began his career at Crédit Agricole Asset Management in 1999 as a risk manager and worked as a fund manager for Natixis AM and Finaltis. He founded a fintech called Riskelia, which was acquired by Homa Capital, where he was CIO and created several quantitative funds.

Jean-Jacques received the Lipper Award in 2019 for the best Futures fund managed over three years. He is a regular guest on Financial TV. He is an alumnus of the CentraleSupélec engineering school and holds a CFA.

Thomas has over 20 years of experience in capital markets, specializing in structured products, derivatives, and Quantitative Investment Strategies (QIS).

He began his career covering Latin America at Commerzbank and Crédit Agricole in London and New York, and then spent 15 years at Société Générale promoting investor solutions to U.S. and Latin American institutions.

Thomas is an alumnus of Dauphine University and Brandeis University.